Mergers and acquisitions (M&A) deals involve integrating two or more companies, often transferring sensitive information and assets. Cybersecurity due diligence evaluates the cybersecurity risks and vulnerabilities of a company or investment acquired as part of an M&A deal. Companies need to conduct cybersecurity due diligence for several reasons:

-

Protect against financial losses: Cyber attacks can result in significant financial losses for a company, including the cost of remediation, lost revenue, and damage to the company’s reputation. Conducting cybersecurity due diligence can help identify potential vulnerabilities and risks that could be exploited by cyber attackers, allowing the company to address them before the M&A deal is completed.

-

Comply with regulations: Many industries have specific cybersecurity regulations that companies must adhere to, such as the Payment Card Industry Data Security Standard (PCI DSS) for companies that accept credit card payments. Failing to comply with these regulations can result in fines and legal penalties. Conducting cybersecurity due diligence can help ensure that the acquired company complies with relevant laws.

-

Protect sensitive information: M&A deals often involve transferring sensitive information, such as customer data, intellectual property, and trade secrets. If this information is not adequately protected, it could be accessed by unauthorized individuals or organizations. Conducting cybersecurity due diligence can help ensure the acquired company has adequate controls to protect sensitive information.

-

Improve the overall security posture: Cybersecurity due diligence can help identify areas where the company being acquired could improve its cybersecurity posture. By identifying and addressing vulnerabilities and risks, the company can improve its overall security posture and reduce the likelihood of a successful cyber attack.

-

Maintain customer trust: Cyber attacks can significantly impact customer trust and loyalty. If a company’s customer data is compromised due to a cyber attack, it could lead to a loss of confidence and a decline in customer loyalty. Conducting cybersecurity due diligence can help ensure that the company being acquired has robust cybersecurity measures, which can help maintain customer trust.

-

Avoid reputational damage: Cyber attacks can significantly impact a company’s reputation. If a company’s cybersecurity defenses are inadequate, it could lead to negative media attention and damage its reputation. Conducting cybersecurity due diligence can help identify potential vulnerabilities and risks, allowing the company to address them before they become a problem.

To conduct effective cybersecurity due diligence, companies should consider the following steps:

-

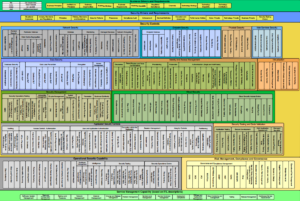

Develop a checklist: Identify the key areas that must be evaluated during the due diligence process, including the company’s cybersecurity policies and procedures, incident response plan, and network security.

-

Review the company’s cybersecurity policies and procedures: Determine whether the company has written policies and procedures to protect sensitive information and prevent cyber attacks.

-

Evaluate the company’s incident response plan: Determine whether the company plans to respond to a cyber-attack or data breach. This should include processes for containing the attack, mitigating any damage, and recovering from the incident.

-

Review the company’s network security: Evaluate its architecture and security controls to determine whether they are sufficient to protect against cyber attacks.

-

Conduct a risk assessment: Identify any potential vulnerabilities or risks that could be exploited by cyber attackers, and determine the likelihood and impact of these risks.

-

Review third-party security: If the acquired company uses third-party vendors or service providers, determine whether they have adequate security measures to protect sensitive information.

-

Review the company’s security training and awareness programs: Determine whether it provides ongoing security training and awareness programs for its employees to help prevent cyber attacks.

-

Review the company’s security testing and monitoring: Determine whether the company regularly conducts security testing and monitoring to identify and address vulnerabilities.

-

Review the company’s security architecture and infrastructure: Evaluate its architecture and infrastructure to determine whether it is sufficient to protect against cyber attacks.

-

Review the company’s security governance: Determine whether it has a formalized process for managing and overseeing its cybersecurity efforts, including assigning roles and responsibilities and establishing clear policies and procedures.

Cybersecurity M&A due diligence is part of a more extensive process, the Technical due diligence of such deals.

Merger and acquisition (M&A) technical due diligence is the process of reviewing the technical aspects of a company that is the subject of an M&A transaction. The goal of technical due diligence is to identify any potential issues or risks that could impact the value of the company or the success of the M&A deal.

The technical due diligence process typically involves the following steps:

-

Identify the scope of the review: The content of the technical due diligence review will depend on the specific assets and operations of the company being acquired. It may include reviewing the company’s technology, intellectual property, product lines, manufacturing processes, and supply chain.

-

Gather relevant data and documents: The due diligence team will gather all relevant data and documents related to the company’s technical operations, including financial reports, patents, contracts, and technical specifications.

-

Conduct interviews and site visits: The due diligence team will interview the company’s management team, employees, and other stakeholders to gather information about the company’s technical operations. They may also visit the company’s manufacturing facilities or other locations to assess the condition of the company’s assets and operations.

-

Assess the company’s technology and intellectual property: The due diligence team will review its technology and intellectual property to assess its value and potential risks or liabilities.

-

Evaluate the company’s product lines and manufacturing processes: The due diligence team will review its product lines and manufacturing processes to assess their efficiency and competitiveness.

-

Review the company’s supply chain: The due diligence team will assess its supply chain to ensure it is reliable and efficient.

-

Prepare a report: Based on the technical due diligence review findings, the due diligence team will prepare a report detailing any identified issues or risks and any recommendations for addressing them. This report will be shared with the parties involved in the M&A transaction to help inform their decision-making.